The calculation for Furusato Nozei deduction's upper limit and simple simulation

Before applying for Furusato Nozei donation, first check your own “deduction limit”. Here, we will explain in detail four points about tax deductions: the mechanism of deduction, simulation of the maximum amount of deduction, specific examples, and points to note.

If you want to check the approximate deduction limit immediately, please check below.

Point 1A mechanism to keep your own expense at 2,000 yen

Furusato Nozei donation is legally treated as "donation". Donations are tax deductible when you file a final tax return. Furusato Nozei (excluding the amount of 2,000 yen co-payment) can also be deducted from income tax and resident tax from the amount donated within the maximum deduction amount (determined by annual income, family composition, etc.).

For example, if you apply for Furusato Nozei of 10,000 yen once to one Municipality, the deduction will be 8,000 yen(10,000 yen- 2,000 yen). In addition, even if you apply for Furusato Nozei of 10,000 yen each to five Municipalities and donate 50,000 yen in total, your co-payment will be 2,000 yen, and the remaining 48,000 yen will be deductible.

However, the tax deducted will not be refunded in full to your account. It changes depending on the application method for the deduction (final tax return or one-stop special application). In the final tax return, income tax and resident tax are refunded and deducted separately, but in the "One-stop Special System," there is no refund from income tax, a deduction only from resident tax. The total amount after subtracting the co-payment amount from the maximum deduction amount will be deducted from the resident tax.

For example, if you paid 10,000 yen for Furusato Nozei, the refund and deduction will be as follows.

*If you have income other than salary, the income tax may be deducted as a reduction of the tax amount instead of a refund.

- 1. Income tax refund

- {Maximum deduction amount - 2,000 yen} × Income tax rate (0-45% depending on income amount)

- If you donate 10,000 yen and the income tax rate is 10%, 800 yen will be refunded. The income tax rate varies depending on the taxable income amount, and the 10% tax rate is applied when the income amount exceeds 1.95 million yen and is 3.3 million yen or less.

- 2. Deduction from resident tax (for basic portion)

- {Maximum deduction amount - 2,000 yen} × 10%

- If you donate (pay tax of) 10,000 yen, 800 yen will be deducted from resident tax.

- 3. Deduction from resident tax (for special portion)

- {Maximum deduction amount - 2,000 yen} × {100% - 10% (tax deduction for basic portion) - income tax rate}

- If you donate (pay tax of) 10,000 yen, 6,400 yen will be deducted from resident tax.

Generally, income tax is already deducted when you receive your salary. Therefore, the income tax deduction will be refunded (transferred) to your account later. On the other hand, resident tax is paid in the following year based on the income from January 1st to December 31st. Since the donation will be deducted from the resident tax of the following year of donation, the amount of the deduction will reduce the amount of resident tax that would otherwise have been paid.

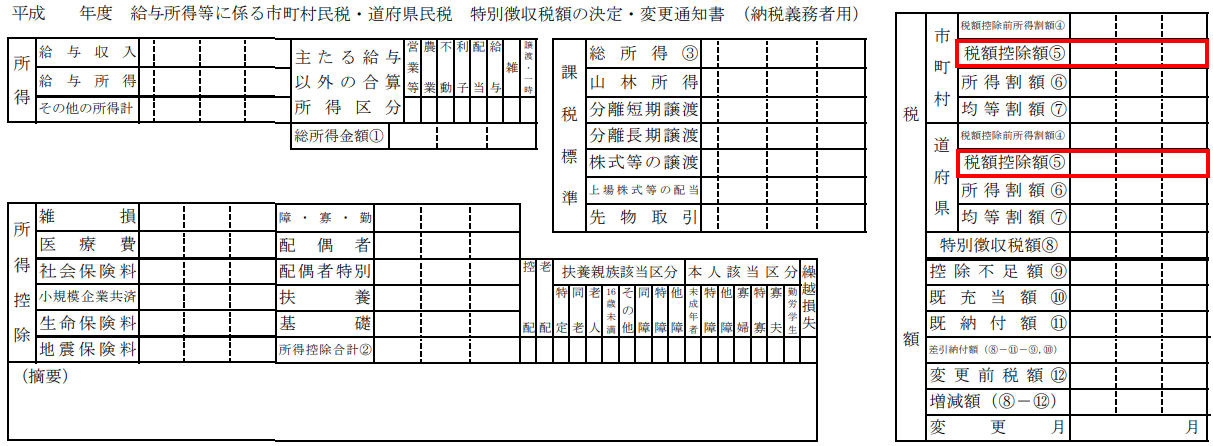

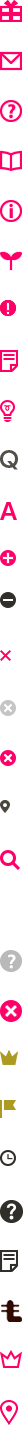

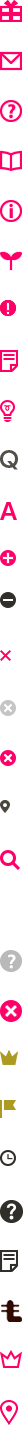

Deductions for income tax will be credited to your account as a refund, so you can check it in your account. Since the resident tax will be deducted from the resident tax to be paid in the following year of donation, it can be confirmed in the “resident tax decision notification”.

The "resident tax decision notification" is distributed by your workplace or Municipality around June every year. You can confirm the deduction in the notification you receive around June of the following year of donation. The tax amount column includes municipal inhabitant tax and prefectural inhabitant tax, and the amount deducted from resident tax is included in the total of the two items called "tax credit amount."

To explain in detail, the “tax credit amount” is the sum of deductions for Furusato Nozei and others. Among them, adjusted deduction will be subject to all the people. At least 2,500 yen combining municipal and prefectural tax will be deducted through the adjusted deduction.

Therefore, Furusato Nozei deduction amount can be roughly calculated using the following formula.

Deduction amount from resident tax in Furusato Nozei payment= Total amount of tax deduction - 2,500 yen

However, not only adjustment deductions but also housing loan deductions and dividend deductions are included, so if you want to check the exact amount, please contact your local Municipality.

Point 2 Calculation method and simulation for deduction limit

The donated amount, minus the 2,000 yen of co-payment, can be refunded or deducted from income tax or resident tax. However, please note that this does not mean that you will be deducted in any amount.

For example, if you donate 100,000 yen , you may be able to deduct 98,000 yen subtracting 2,000 yen, but you cannot deduct the amount exceeding the maximum deduction amount. The amount deducted will vary depending on the donor's annual income and family composition.

It is important to check the upper limit of the deduction, "How much can I afford to pay for Furusato Nozei?" So, here are three ways to find out what the appropriate deduction limit is.

- For those who want a rough estimate Furusato Nozei Easy Simulation & Guideline List

-

By selecting your "salary income" and "family structure", you can simulate the "amount estimate of Furusato Nozei" that will deduct the entire amount except for the 2,000 yen co-payment.

-

For the person who applys for Furusato tax

Salary income

-

For the person who applys for Furusato Nozei

Family structure

Approximate maximum Furusato Nozei donation amount

The maximum donation amount is 2,000 yen at your own expense. (% fundingMax | format_number %)yenis

*Maximum donation amount (% fundingMax | format_number %)yen = self-pay amount (% donateFeeSimple | format_number %)yen + tax deducted amount (% amountDeductionTaxSimple | format_number %)It's yen *The amount will be displayed when you select "Salary Income" and "Family Structure"This simple simulation is based on the list of estimated Furusato Nozei amounts (from 2015), which is deducted in full except for the 2,000 yen of self-payment. The list is summarized on the website of the Ministry of Internal Affairs and Communications. This is only a guideline, so if you want to check the exact amount, please contact your local Municipality, the tax office in your jurisdiction, or an expert such as a tax accountant.

*Especially please be careful if you receive housing loan deductions or medical expense deductions ( Point 4: Points to note when calculating tha amount of deductions ).Details of the list are as follows.Salary income of the person who pay taxes Family composition of those who apply for Furusato Nozei Single or

Working together*1Married couple*2 Co-worker

+ 1 child

(High school student *3)Co-worker

+ 1 child

(University student*3)Couple

+ 1 child

(High school student)Co-worker

+ 2 children

(University student and high school student)Couple

+ 2 children

(University student and high school student)3 million yen 28,000 19,000 19,000 15,000 11,000 7,000 - 3.5 million yen 34,000 26,000 26,000 22,000 18,000 13,000 5,000 4 million yen 42,000 33,000 33,000 29,000 25,000 21,000 12,000 4.5 million yen 52,000 41,000 41,000 37,000 33,000 28,000 20,000 5 million yen 61,000 49,000 49,000 44,000 40,000 36,000 28,000 5.5 million yen 69,000 60,000 60,000 57,000 48,000 44,000 35,000 6 million yen 77,000 69,000 69,000 66,000 60,000 57,000 43,000 6.5 million yen 97,000 77,000 77,000 74,000 68,000 65,000 53,000 7 million yen 108,000 86,000 86,000 83,000 78,000 75,000 66,000 7.5 million yen 118,000 109,000 109,000 106,000 87,000 84,000 76,000 8 million yen 129,000 120,000 120,000 116,000 110,000 107,000 85,000 8.5 million yen 140,000 131,000 131,000 127,000 121,000 118,000 108,000 9 million yen 152,000 143,000 141,000 138,000 132,000 128,000 119,000 9.5 million yen 166,000 157,000 154,000 150,000 144,000 141,000 131,000 10 million yen 180,000 171,000 166,000 163,000 157,000 153,000 144,000 15 million yen 395,000 395,000 377,000 373,000 377,000 361,000 361,000 20 million yen 569,000 569,000 552,000 548,000 552,000 536,000 536,000 25 million yen 855,000 855,000 835,000 830,000 835,000 817,000 817,000 *1 “Double-income” refers to the case where the person who apply for Furusato Nozei is not eligible for the spousal (special) deduction. (If the spouse's salary income exceeds 2,010,000 yen)

*2 “Couple” refers to the case where the spouse of the person applying for Furusato Nozei has no income.

*3 "High school student" refers to "dependents aged 16 to 18", and "university student" refers to "specified dependents aged 19 to 22".

*4 Children of junior high school age and younger do not need to be included in the calculation (because they do not affect the amount of the deduction). For example, a couple with one child (elementary school student) will receive the same amount as a couple. In addition, "a couple with two children (high school and junior high school students)" will be the same amount as "a couple with one child (high school student)".Please also use the Excel sheet that calculates (simulates) the donation deduction amount by entering your salary income, family composition, and donation amount.

-

- Enter conditions and simulateFurusato Nozei deduction simulator

-

By entering the information of the donor and his/her dependents, we will calculate the approximate amount that can be deducted from Furusato Nozei. *Accurate simulation is possible by entering the information of the year of donation (January 1st to December 31st). *If possible, please prepare a copy of your withholding tax slip or final tax return form.

About donator

-

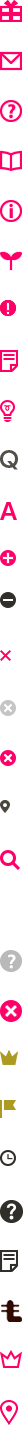

Salary income amount (annual income) *This is the face value salary amount. Please refer to "Payment Amount" on the withholding tax slip.

close

(% errors.salaryIncome %)* yen -

Amount of social insurance fees, etc. *Includes health insurance fees, nursing care insurance fees, welfare pension insurance fees, and employment insurance fees. Please check the National Tax Agency website for details.

https://www.nta.go.jp/taxes/shiraberu/taxanswer/shotoku/1130.htm

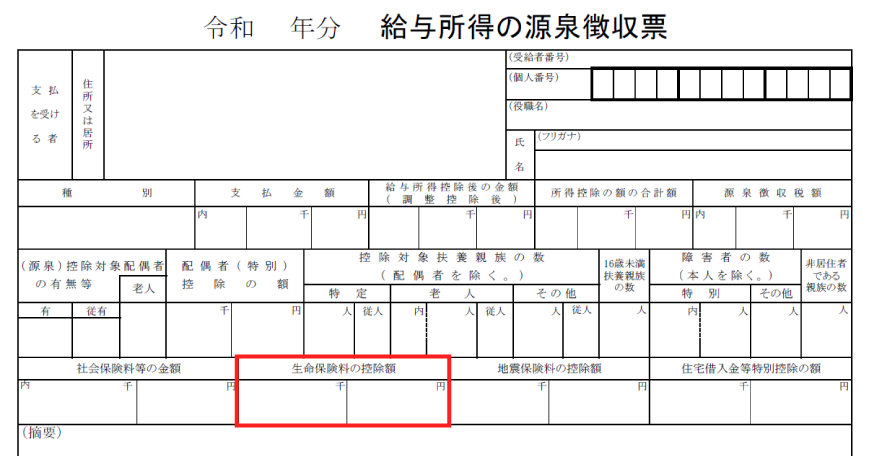

*If you have a withholding tax slip in hand, please refer to the following.

close

close

(% errors.socialInsurancePremium %)* yen -

Amount of deductions for life insurance fees *If you have a tax withholding slip at hand, please refer to the following.

close

(% errors.lifeInsuranceDeduction %)

close

(% errors.lifeInsuranceDeduction %)

* yen

* yen -

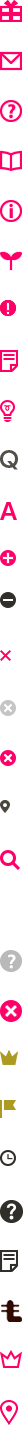

Amount of deductions for earthquake insurance fees *If you have a tax withholding slip at hand, please refer to the following.

close

(% errors.earthquakeInsuranceDeduction %)

close

(% errors.earthquakeInsuranceDeduction %)

* yen

* yen -

Application of special provisions *If you are a working student, or if you are receiving a widow deduction or a disability deduction, please select the appropriate item. For other people, please select "No exceptions"

close

(% errors.specialCase %)Optional

About dependents

If you have applicable dependents, please enter the information in each item. If there is no applicable person, please check the result by leaving the column blank.Spouse

-

Existence of spouse eligible for deduction *The income of the person (limited to those whose total income is 10 million yen or less (*1)) and the spouse who makes the same living is 380,000 yen or less (in the case of salary only) If your employment income is 1,030,000 yen or less, your spouse will be eligible for the deduction (eligible for the spousal deduction). Please select your spouse's age as of December 31st of the year. Otherwise, please select "None".

*1 In the case of employment income only, the "payment amount" (amount of employment income) on the withholding tax slip is 12.2 million yen or less, or the "amount after deduction of employment income" on the withholding tax slip is 10 million yen or less.

close (% errors.spouseForDeduction %)

Optional

(% errors.spouseForDeduction %)

Optional -

Even if there is no spousal deduction, the spouse's salary income is subject to a special deduction *Even if you select "None" for "Presence of a spouse eligible for deduction", there is a possibility that you can receive a certain deduction due to the special deduction. Yes (only if the person's total income is less than 10 million yen and the spouse's annual salary income is more than 1,030,000 yen but less than 2,016,000 yen).

*The amount of deduction varies depending on the amount of salary income, so by entering the amount of salary income, the corresponding deduction amount will be reflected in the calculation results.

*Please note that the calculation results will be different if you have income other than salary.

close (% errors.spouseSalaryIncome %)

Optional yen

(% errors.spouseSalaryIncome %)

Optional yen

Number of dependents

-

Under 15 years old

(% errors.dependentU15 %)Optional 人 -

16-18 years old

(% errors.dependent16to18 %)Optional 人 -

19-22 years old

(% errors.dependent19to22 %)Optional 人 -

23-69 years old

(% errors.dependent23to69 %)Optional 人 -

Over 70 years old (parents/grandparents living together)

(% errors.dependentO70Together %)Optional 人 -

Over 70 years old (other than above)

(% errors.dependentO70Other %)Optional 人 -

Number of people with disabilities among the above

(% errors.dependentHandicapped %)Optional 人 -

Number of people with special disabilities among the above

(% errors.dependentSpHandicapped %)Optional 人 -

Number of people with special disabilities living together among the above

(% errors.dependentSpHandicappedTogether %)Optional 人

Approximate maximum Furusato Nozei donation amount

The maximum donation amount is 2,000 yen at your own expense.(% contributionMax | format_number %)yenis

*Maximum donation amount (% contributionMax | format_number %)yen = self-pay amount (% donateFee | format_number %)yen + tax deducted amount (% amountDeductionTax | format_number %)It's yen *The amount will be displayed when you fill out the input form.In the case of applying to the housing loan tax reduction system

Depending on the tax amount (income amount) and the amount eligible for the deduction, if you apply to the housing loan tax reduction system and receive deductions, there are possibilities that the deduction amount is slightly reduced when you use the Furusato Nozei together.

* In order to see the calculation results, it is necessary to enter the required items in the "Furusato Nozei Deduction Simulator". *If you do not enter anything, the calculation result of the Furusato Nozei Simulator (Furusato Nozei donation maximum amount) will be reflected in ③ “Amount of Furusato Nozei Donation / Planned Donation Amount”. If the maximum amount and the amount actually donated are different, or if the difference is negative due to Furusato Nozei, it is possible to enter a value in ③ and perform a simulation.

Once you have confirmed the maximum donation amount for Furusato Nozei, you can also enter the items related to housing loan deductions below. You can check whether the deduction amount of housing loan tax will change if you apply for Furusato Nozei.

If the "difference due to Furusato Nozei" is 0 yen, the full amount can be deducted under both systems. On the other hand, if the difference becomes negative, the amount that can be deducted from the housing loan will decrease accordingly.

However, in most cases, since the amount is small, the balance will be positive when considering the Gift of Thanks that can be received with Furusato Nozei. Detailed information is also explained in "About applying for both housing loan tax reduction system and Furusato Nozei.'' Please try to reference.-

① housing loan deduction application date *Please select the period that includes the start date of residence (*1) in the applicable property.

*1 This is the start date of residence as stated in the calculation statement for special deductions for housing loans, etc., which is submitted when filing the final tax return of the system. You will receive this deduction in the year-end adjustment from the second year onwards, so if you have been issued a deduction certificate, it will be stated on the deduction certificate. If a special deduction for housing loans, etc. is applied to the year-end adjustment, it will also be listed on the withholding tax slip.

close

* -

②Special deduction for housing loans *The smaller amount below is multiplied by a certain rate (1% for 2009 and later), rounded down to the nearest 100 yen.

・Year-end loan balance related to applicable properties ・Acquisition amount of applicable properties

*These are the items to be included in the calculation statement for special deductions for housing loans, etc., to be submitted when filing a tax return in the first year of final tax return of the system. If it is from the second year onwards, the details will be included in the special deduction form for housing loans, etc. If a special deduction for housing loans, etc. is applied to the year-end adjustment, it will also be listed on the withholding tax statement.

close

(% errorsHousingLoan.housingBorrowingSPDeduction %)* yen -

③Amount donated through Furusato Nozei/

Amount you plan to donate *Initially, the amount will be the same as the "Estimated maximum Furusato Nozei donation amount" displayed above. By entering the amount you actually donated and the amount you plan to donate, the estimated impact on the housing loan deduction amount displayed below will change.

close

(% errorsHousingLoan.amountToBeDonated %) (% warnings.amountToBeDonated %)Optional yen

Estimated impact on housing loan deduction amount

* The housing loan deduction amount is the total deduction amount from income tax and resident tax.

Housing loan deduction amount before applying for Furusato Nozei

(% housingLoanDeductionBeforeHometownTaxPayment | format_number %)yen

Housing loan deduction amount after applying for Furusato Nozei

(% housingLoanDeductionAfterHometownTaxPayment | format_number %)yen

Difference due to applying for Furusato Nozei

(% differenceDueToHometownTaxPayment | format_number %)yen

Notes

* Calculations are based on laws and regulations as of January 2018, and may change due to future revisions of laws and regulations.

*Depending on your income in the year you actually donated, you will receive an income tax refund or a tax deduction from the following year's resident tax. The trial calculation result in this simulation is only a guideline, and do not promise the maximum donation amount or the co-payment amount. We cannot provide any guarantees regarding the trial calculation results even if any trouble, loss, or damage occurs.

* Income other than employment income is not included in this calculation.

*Those who are exempt from resident tax are not eligible for this estimate.

*The deduction amount varies depending on the annual income, donation amount, household structure, and other deductions. As this service cannot answer the specific calculation of the maximum donation amount, please contact your local Municipality, the tax office in your jurisdiction, or an expert such as a tax accountant.

-

- Calculate yourself based on the conditionsHow the deduction is calculated

-

-

Calculation formula for the maximum deduction amount for Furusato Nozei

The maximum deduction amount that can be deducted for Furusato Nozei can be calculated using the following formula.

Deduction limit = Personal resident tax income rate x 20%100% - Basic resident tax 10% - (income tax rate x reconstruction tax rate 1.021) + Co-payment of 2,000 yen

-

As mentioned at the beginning, the Furusato Nozei deduction amount consists of three items as shown in the figure.

Deduction amount for Furusato Nozei= Deduction amount for income tax + Deduction amount for basic resident tax+ Deduction amount for special resident tax

-

The deduction limit for each item is determined as follows, and if even one of them applies, that amount becomes the standard for the limit (in other words, even if the deduction amount for income tax does not reach 40% of the total income, if the amount deducted from the special resident tax exceeds 20% of the individual resident tax income rate, the co-payment will increase.) In reality, 20% of the personal resident tax income rate is the standard for calculating the limit amount.

- ・Maximum deduction amount from income tax = 40% or less of gross income

- ・Maximum deduction amount from basic resident tax= 30% or less of gross income

- ・Maximum deduction amount from special resident tax = 20% of personal resident tax income rate amount

-

Based on the above, when trying to find the deduction limit for Furusato Nozei, the following formula is below.

Deduction for special resident tax[(Furusato Nozei amount - 2000) x (100% - 10% - income tax rate x reconstruction tax rate)]

<Individual resident tax income rate x 20% -

In other words, if the Furusato Nozei amount is less than [(individual resident tax income rate x 20%) ÷ (100% - basic 10% - income tax rate x reconstruction tax rate 1.021) + self-pay 2,000 yen], the full amount will be deducted. (Excluding the co-payment of approximately 2,000 yen).

Column

(Reference) What is the personal resident tax income rate amount?Among resident tax, the taxable portion according to income is called income rate (other types include per capita levy, where a flat amount is taxed, dividend levy, which is taxed on dividends and capital gains from stocks, stock transfer income levy, etc.) For details, please refer to the column "Regarding Local Taxes" ).

As mentioned in the Point 1 column (Checking the deduction amount), the resident tax decision notification that is distributed around June every year lists the amount to be collected based on the previous year's income. There are municipal inhabitant tax and prefectural resident tax, and the sum of the incom rate of those will be the amount of the personal resident tax rate.

If you see the rough estimate from the previous year's income

The exact amount of personal resident tax income rate cannnot be calculate until the income is fixed sine it is determined according to the year's income. However, if your income or family composition has not changed much, you can check a rough estimate based on your previous year's income.

If you want to check a rough estimate based on your previous year's income, please sum the "income rate before tax deduction" in the municipal tax column and the "income rate before tax deduction" in the prefectural tax column.

-

Point 3 Concrete examples of deduction limits

Here, let's calculate the amount with a specific example according to the calculation formula introduced in Point 1 and Point 2.

Case 1: A family of four, a couple and two children, with a salary income of 7 million yen. The applicable income tax rate is 10%, the resident tax income rate is 293,500 yen, and if this family donates 30,000 yen as in "Furusato Nozei".

- Income tax (including special income tax for reconstruction)

- (1) Income tax (30,000 yen- 2,000 yen) x 10% = 2,800 yen

(2) Special income tax for reconstruction: 2,800 yen x 2.1% = 58.8 yen - (1) 2,800 yen+ (2) 59 yen for a total of 2,859 yen. However, in an actual operation, the amount less than 100 yen will be rounded down to 2,800 yen .

- Resident tax

- ① Basic amount: (30,000 yen- 2,000 yen) x 10% = 2,800 yen

② Exception: (30,000 yen- 2,000 yen) x (90% - 10% x 1.021) = 22,341 yen - However, in an actual operation, the amount less than 100 yen will be rounded up, so the amount will be 22,400 yen. In addition, in case 1, the amount for the exception is within 20% of the resident tax amount of 293,500 yen, so it is fully deductible.

(1) 2,800 yen+ (2) 22,400 yen for a total of 25,200 yen . - In case 1, a total of 28,000 yen(2,800 yen (2,859 yen ) for income tax and 25,200 yen ( 25,141 yen ) for resident tax) will be refunded or deducted.

Case 2: If you donate 80,000 yen under the same conditions as “ Furusato Nozei ”

- Income tax (including special income tax for reconstruction)

- (1) Income tax: (80,000 yen- 2,000 yen) x 10% = 7,800 yen

(2) Special income tax for reconstruction: 7,800 yen x 2.1% = 164 yen - (1) 7,800 yen+ (2) 164 yen for a total of 7,964 yen. However, in an actual operation, the amount less than 100 yen is rounded down to 7,900 yen .

- Resident tax

- (1) Basic amount: (80,000 yen- 2,000 yen) x 10% = 7,800 yen

(2) Exception: (80,000 yen- 2,000 yen) x (90% - 10% x 1.021) = 62,236 yen - However, in an actual operation, the amount less than 100 yen will be rounded up to 62,300 yen . In addition, in case 2, the amount of the exception is more than the limit of 58,700 yen, which is 20% of the resident tax amount of 293,500 yen, so the full amount cannot be deducted. You can deduct up to the limit of 58,700 yen.

(1) 7,800 yen+ (2) 58,700 yen for a total of 66,500 yen . - In case 2, 74,400 yen,which sums the income tax of 7,900 yen(7,964 yen) and resident tax of 66,500 yen, be refunded or deducted.

Case 3: When calculating the maximum amount of donations for this family

- [Personal resident tax income rate amount x 20% ÷ (90% - income tax rate x 1.021)] + 2,000 yen

The amount calculated by this formula will be the maximum amount of donation. - 293,500 yen x 20% ÷ (90% - 10% x 1.021) + 2,000 yen= 75,568 yen

- In this example, the maximum donation amount will be 75,568 yen. In other words, you can donate up to 75,000 yen, which is the maximum amount of donation, and 73,000 yen will be refunded or deducted from income tax and resident tax. As shown in example 2, a donation of 80,000 yen will not be deducted in full.

- In Case 3, the maximum donation amount is 75,568 yen .

Point 4Notes on calculation of maximum deduction amount

You need to be especially careful if you are receiving deduction of housing loan medical expenses.

The deduction amount simulation, guideline list, and calculation formula introduced in Point 2 are patterns that do not include deductions such as housing loan deductions and medical expense deductions. If you apply to any of the following three conditions, please note that the maximum amount that can be deducted for Furusato Nozei may change.

- For those who receive tax deductions other than Furusato Nozei, such as housing loan deductions and medical expenses deductions

- Income tax and resident tax are determined by your income for the year. The maximum amount that can be deducted on final tax return is the amount of tax determined based on your income. In other words, by deducting housing loan and medical expenses, the amount that can be deducted for Furusato Nozei may decrease. In particular, please note that the amount of the housing loan deduction is large, so you may reach the maximum amount that can be deducted from the housing loan deduction alone. In addition, by entering the information in the "If you are using the housing loan tax reduction system" section under Point 2's deduction amount simulator, you can check whether the amount of deduction from the housing loan tax reduction will change if you apply for Furusato Nozei. Please use this as a reference.

- If you did not reach your expected income

- You cannot see your annual income until your income from January 1st to December 31st is confirmed. If you are a company employee, you can predict to some extent based on your previous year's income and monthly salary. But some self-employed people and freelancers can not estimate their annual income because their income varies from month to month. There also may be possibilities of decreasing income due to retirement, injuries, or diseases, etc. When the income decreases, the amount of tax and the maximum amount you can deduct will also decrease. You may be unable to deduct the full amount of your donation because your income is less than the income estimated at the beginning of the year.

- For those whose family structure changes

- Be careful if your family structure changes, such as having a new child or living with your parents and increasing the number of dependents.

Personal resident tax is a tax that pays the expenses necessary for administrative services provided by prefectures and municipalities, depending on the person's ability to pay. There are "individual prefectural (metropolitan and prefectural) inhabitant tax'' and "individual city (ward, town, village) inhabitant tax.'' Generally speaking, the combination of these two is "individual resident tax'' or "resident tax.'' "Individual resident tax" consists of "Income rate" which is taxed according to the amount of income of the previous year, "Per capita rate" which is taxed at a fixed amount regardless of income amount, "Interest rate" which is taxed on interest on deposits and savings, etc., "dividend rate'', which is taxed on dividends from certain listed stocks, etc., and the "stock capital gains rate", which is taxed on capital gains from stocks, etc. in withhokding accounts.

Regarding the "income tax" and "per capita tax," those who reside as of January 1st are subject to pay tax, and each Municipality collects "individual prefectural (metropolitan and prefectural) inhabitant tax" and "individual city tax" together. Furthermore, even if you do not actually live there, if you own a house or office, you will be taxed at the per capita rate. If you are a salaried employee, the tax will be collected from your monthly salary. For others, the tax will be paid with the tax notice sent by the municipality.

Regarding "interest rate", "dividend rate", and "stock capital gains rate", financial institutions such as banks, companies that pay dividends, securities companies, etc., will collect them when they pay the compensation for interest, dividends, or stocks in the withholding account. The tax is paid to the prefecture where the person who receives the payment (however, in the case of the interest rate, the office where deposits are made, etc.). Regarding capital gains from stocks, the procedure may change depending on the type of the account applied to the securities company and the transaction. For details, please consult your tax office or tax accountant.

- What is income rate

- "Income rate amount ... (total income amount of the previous year - income deduction amount) x tax rate - tax deduction amount"

- What is income amount

- It is the amount of income for the previous year, divided into 10 types by income generation, such as salary, interest, business, etc., and subtracted from the amount of income for the year, minus necessary expenses, etc. Employment income includes a deduction for employment income as the equivalent of a necessary expense.

- What is income deduction

- There are various deductions such as medical expense deduction, social insurance fees deduction, dependent deduction, and spousal deduction.

- What is tax rate

- In principle, it is a flat rate of 10% (4% of prefectural tax, 6% of municipal tax).

- What is the tax deduction amount?

- It is subtracted from the amount of confirmed tax. In resident tax, there are various deductions such as "dividend deduction," "donation tax deduction," "housing loan deduction," and "adjustment deduction."

That's all for "Calculation formula and simple simulation for the upper limit of Furusato Nozei deduction."

On MOGUFULL, you can search for the Gift of Thanks by ranking , etc. Let's check it out right away.

What is Furusato Nozei?

We will provide an easy-to-understand explanation about Furusato Nozei system, its benefits, procedures, notes, topics about taxes that you might be interested in, and various Q&As.

Precautions when using "MOGUFULL"

- ・In this service, we provide information about Furusato Nozei with due care. We do not make any guarantees (regardress of express or implied) regarding accuracy, immediacy, safety, legality, purposiveness, etc. of the content. In addition, the Company will not be responsible for any damages or disadvantages to customers or third parties. Customers should use the information at their own discretion and responsibility.

- ・This service cannot answer questions about donations and tax payments. Please contact the municipality, tax accountant, or other expert.

![[Limited time offer] Natsumonogatari (cold-brewed sencha) 6 bags K111-039_03](https://mogufull.jp/icv/product/462012-109668/X228.152_productmain_k111-039-03_110927_orig_1718016150.jpg)

![ZE6441_[Freshly squeezed with all my heart] 100% juice {Arita mikan, Kiyomi, Shiranui} 180ml 10 bottles each, total 30 bottles](https://mogufull.jp/icv/product/303615-110162/X228.152_productmain_ze6441_111421_orig_1719360012.jpg)

![[Pre-orders accepted for shipments starting mid-August] Approximately 5kg of "Pears" from Naruto-shi, Tokushima[Limited quantity] Kosui, Hosui, Akizuki, Shinko](https://mogufull.jp/icv/product/362026-82473/X228.152_productmain_5527954_83732_orig_1719398605.jpg)

![[Pre-order for 2024] [New rice produced in 2020] Carefully selected by a long-established rice store Made in Niigata Traditional variety Koshihikari "Nanatani rice" 2 kg of unwashed rice Long-lasting freshness with nitrogen gas filled pack Kaneko Rice Store](https://mogufull.jp/icv/product/152099-82564/X228.152_productmain_5535198_83823_orig_1711442347.jpg)

![T-14 [6 Month Subscription] Japanese Honey Bee Takachiho Pure Honey 600g x 2 Set](https://mogufull.jp/icv/product/454419-81459/X228.152_productmain_5477815_82718_orig_1717978360.jpg)

![[Kichijoji Toraya, a long-established store founded in 1947] Kichijoji souvenir Yoshitora Dorayaki and Mrs. Musashino's 12-piece set 2 types Japanese sweets Western-style Japanese sweets Assortment](https://mogufull.jp/icv/product/132039-92672/X228.152_productmain_5931726_93931_orig_1711903967.jpg)

![Yamanashi peaches overflowing with bright sweetness and aroma 1.5kg or more 5-6 pieces [shipped in 2024] (RG) B-842](https://mogufull.jp/icv/product/192139-86009/X228.152_productmain_5712083_87268_orig_1719400712.jpg)